Last week I talked about why you need an emergency fund. It’s saved our life multiple times, and I hope I convinced you to go ahead and start one! Today I show you how to set up an emergency fund, and 6 ways to fill it!

John and I follow Dave Ramsey almost religiously, and although we’re not in debt and didn’t use his system to get out of debt, we’re working on his famous Baby Steps so we can live like no one else. Keep this in mind as you’re reading, as a lot of what you’ll see here is what Dave has said as well.

The two ways I recommend you set up an emergency fund are: Set up a new sub-savings account at your bank to use just for your fund, or use your main savings account and have a way to earmark how much is for emergencies.

To set up a sub-savings account, all we had to do was simply go to our bank and say we wanted to make a sub-savings account. From there, we could name it whatever we wanted; so in this case, it could be Emergency Fund. One benefit is that you know exactly how much is in there at any given time, and you know (hopefully) not to take out money just because.

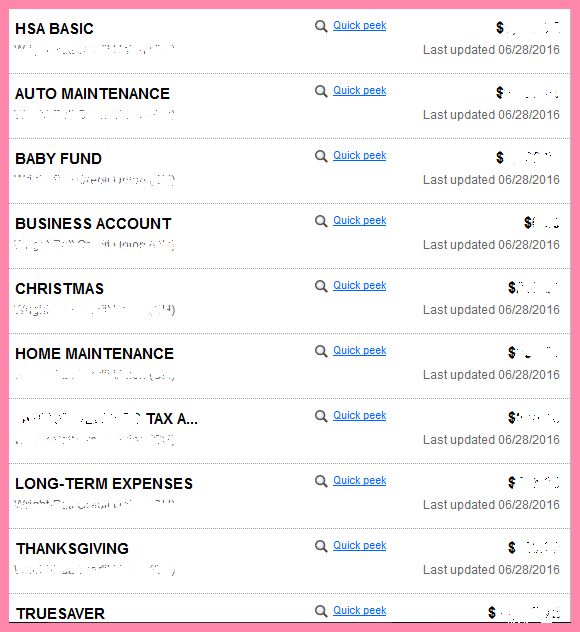

We never actually used a sub-savings account for our emergency fund; instead, we use a free app called GoodBudget to earmark the money we have on one account into many different categories, or “envelopes”. What you see in the image above actually uses our checking account, but you can easily turn it around and use it for savings. Here are some category/envelope ideas you can use to separate your money:

- Emergency

- Auto/Home Repairs

- Vacation

- Christmas/Birthdays

- Baby Fund

We use both separate accounts and earmarking to keep track of our money, and both are great in their own way. You’ll have to play around and see what works best for you; just make sure you know exactly where your money’s going!

How much should you have in your emergency fund?

How much you keep in your emergency fund depends on where you are financially. According to Dave Ramsey, if you’re paying off debt (Baby Step 2), you should build your savings to just $1,000 to cover any basic emergencies.

Once you’re out of debt, he recommends building it up to 3-6 months worth of your monthly expenses, and that’s what we did. Dave says that if your job is pretty steady and there’s no likelihood of you losing your job anytime soon, you can keep your fund closer to the 3 month mark.

If you’re like us (unfortunately) and have gone through multiple jobs in a short period of time, keep it closer to 6 months. You don’t have to hoard all the money; just make sure you have enough to get by if you suddenly find yourself without income.

6 Ways to build your emergency fund:

Have a garage sale

We actually held two garage sales this year; one in April and one in June. It was mostly to get rid of a lot of junk we had, but also to have a little extra money because John was unemployed at the time. I think we made almost $400 by selling my old video games, books, baby items, and other odds and ends. Make sure you read my post 24 Tips For a Successful Garage Sale!

Sell items on Ebay

If you have items that are a little too valuable to sell at a garage sale, try Ebay instead. It may take a little longer, but you’ll make more money. I checked the prices of some of my video games before putting them in the garage sale, and I’m glad I did. One of them ended up being pretty rare and can sell for over $100!

Do odd jobs

This could be anything; mowing grass, shoveling snow, even using skills like fixing computers or designing artwork. Think about the skills you have, and how you can make money with it. Somebody out there needs you.

Give up SOMETHING you spend money on, and put that money towards your emergency fund

Are you addicted to Starbucks like I am and get one every morning? Or maybe you go out to lunch every day. Think about whatever it is that you could be spending unnecessary money on, and make some changes to put that extra money into your emergency fund.

Instead of buying Starbucks, wake up a little earlier and brew your own at home. Pack your lunch the night before so you have no excuse to go out the next day. Little things like that can add up! If you spend $2.00 on coffee 5 mornings a week, you’d be able to put at least $80.00 a month into your emergency fund after stopping your coffee runs!

Have it come automatically out of your paycheck

We do this with a lot of our accounts: Christmas, general savings, auto… the idea is that if you don’t have to think about the money going in, you won’t be tempted to spend it! You can set up an automatic transfer for every time you get a paycheck, and it could be a small amount like 10 or 20 dollars each time. It all adds up!

Lower your grocery bill

Your grocery bill is probably one of the easier things to cut back on because it’s very flexible, unlike your house payment. Take a look at how much you spend each week on groceries and try to cut it down however you can, whether it’s through couponing or even giving up certain comfort foods, like chips and soda. Read my posts on meal planning and ways to save $60 a month on groceries to help you get that grocery bill as low as possible!

I know it’s hard. Money’s always difficult to manage at some points, especially when you don’t have a lot of it. I hope these tips will help you build an emergency fund and have peace of mind knowing you’ll be okay in a financial crisis!

Jaime is a Nutrition Coach through the ISSA and professional writer. She has 4 years experience coaching and 9 years experience in writing. She enjoys cooking easy meals, running, and learning more about food.

Jaime specializes in helping women with ADHD learn to meal plan and cook healthier meals without getting overwhelmed.