Budgeting. For some of you, that word might fill you with many different thoughts. “Maybe I need a budget, but I don’t know where to start. How do I do it? Can’t my husband just take care of it? I think we’re doing okay, but can we do better?”

I’ve shied away from general budgeting posts on No Getting Off This Train because, to be honest, John and I just recently started budgeting together. We shared the same bank account, and I knew how much I could spend on groceries, but I let him handle everything else and made myself blissfully unaware. Then we took Dave Ramsey’s Financial Peace University at church, and we committed to finally budgeting together because we finally understood the importance of both spouses being involved.

We’re not experts by any means, but I want to show you how we started and how we do things, to show you how to create a budget with your spouse. This mini-series will be broken up into a few posts, so as not to overwhelm you with information right off the bat!

Set up a date for your first budget meeting

The most important step is scheduling the meeting! Put it on your calendar, at a time when the kids are in bed and you won’t be distracted. I also make sure I’m not too tired or hungry, either, so snacks are a must right after Allison’s bedtime!

Gather expenses from the past few months

Before the meeting, figure out your current expenses. If you keep track of everything already, gather your expenses from the past year; but if not, at least get the last 3 months so you can get an idea of your spending trends. And from now on, keep all receipts where you’ve used your credit or debit card. You can enter the receipts every week, like John does, or once a month, but weekly may be easier on the paper clutter.

Decide what method to keep track of your budget

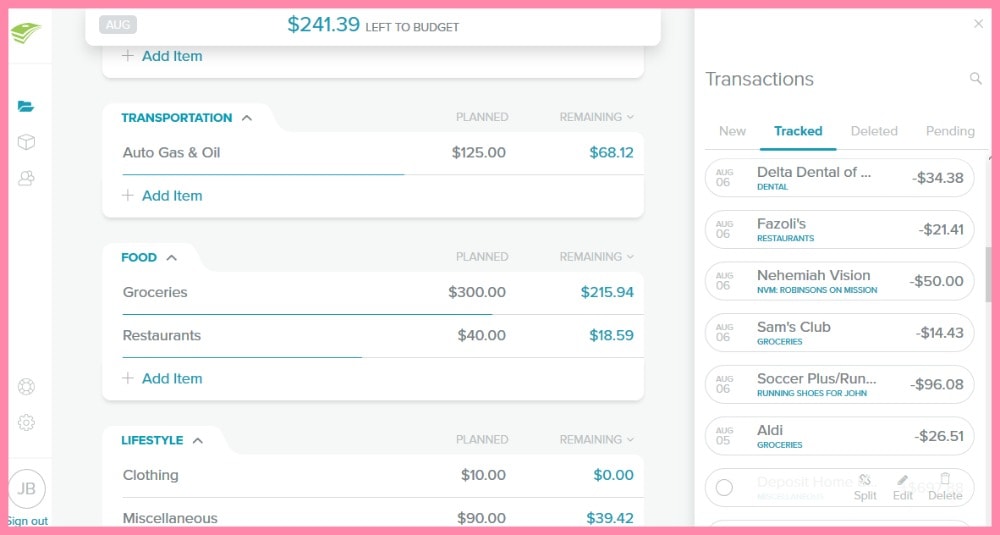

Choose whatever is easiest and most sustainable! Whether it’s on paper, a spreadsheet, or a favorite app like EveryDollar (which is what we use), make sure you can commit to keeping up with it, adding your income and expenses as they come in.

We’re very fond of EveryDollar, especially the paid version. Instead of manually entering our transactions, we’ve synced our bank account to the app and the app will pull all the info it needs for us. We just have to drag and drop the transactions into the category we want; it’s that simple!

Create a zero-based budget

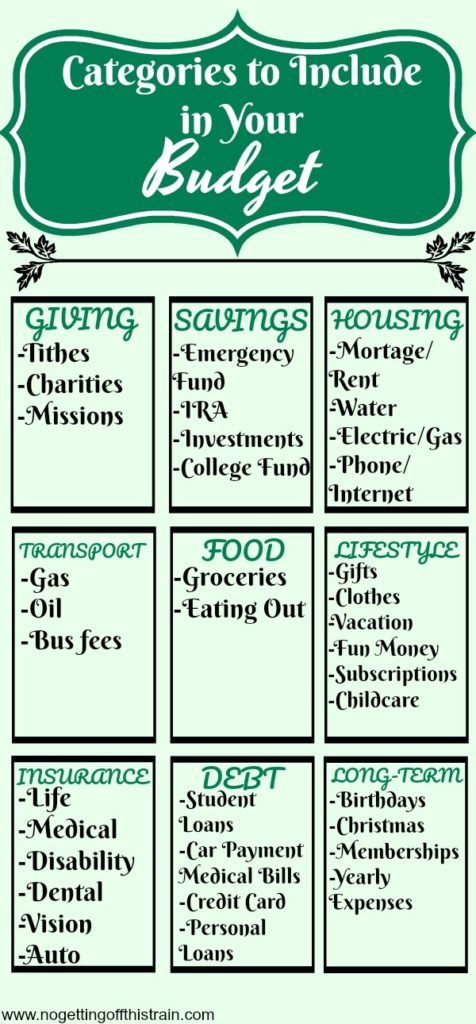

Here’s the fun part- trying to figure out what categories you need to add to your budget! Most categories are generalized and apply to almost everybody, like rent/mortgage, groceries, and gas. Others will be more personalized and you have to think carefully about every place you spend money- like Netflix subscriptions and any memberships you may have. Here’s a list of main budget categories that you’ll need to have:

It’s not a full list, but it covers the basics and will get you started! Once you’ve figured out where your money’s going, you now need to create a Zero-Based Budget: Where your income minus your expenses should equal zero. If you have money left over, great! You can put that extra into savings or something else you might need, to make your budget equal zero. If you’re in the negative, you’ll need to do some tweaking- either take out some categories or don’t spend so much in others.

Make sure you’re on the same page

This is super important. You both have to agree on what you just wrote down; otherwise it won’t work. Saying you’ll only spend $20.00 on clothes this month and then going on a $200.00 shopping spree because the 20 dollars “wasn’t enough money” defeats the purpose of having a budget. If you need $200.00 worth of clothes that month, that’s fine! But you both need to agree beforehand that you’ll put that number in your budget and adjust the rest accordingly.

Also- if your spouse is the one doing the budget, make sure you give him all the receipts and don’t forget about them laying in the bottom of your purse. Not that I’ve done that or anything and given John a mental breakdown figuring out where the missing money went.

Keep track of when all of your expenses are due

Unless you only get paid at the end of each month, you won’t have all of your money at the beginning of the month. You may earn, say, $3,000 a month, but you won’t get it all at once if you get paid weekly, bi-weekly, etc. Most of your expenses come out at different times of the month, so don’t get excited at your first paycheck of the month at $1,000 and buy that $500 item you budgeted for, when the mortgage of $800 is due the next day. It takes careful planning, and if you need to write down your expenses’ due dates on a calendar to help you remember, do it! It’ll save you headaches down the road.

Schedule monthly Budget Committee Meetings

One thing Dave Ramsey recommends is having a monthly Budget Committee Meeting. It’s different from the initial meeting you had above; this meeting is all about reviewing the previous month’s budget and how you did, and tweaking the next month’s budget to reflect any changes that might happen- like birthdays, holidays, back-to-school, etc. These meetings are a must and cannot be skipped, so make sure you put them on your calendar! John and I have our meeting the last Sunday of the month so we have time to review and make edits to the budget.

Following these ideas is just the first step. You both have to commit to sticking to your new budget, to remain accountable, and most important, to keep loving each other as you adjust to your new lifestyle changes. It won’t be easy at first, but with every month that goes by, you’ll find yourselves easily putting together the next month’s budget with no problems! So your first steps are:

- Set a date for your initial budget meeting.

- Gather your expenses from the past 3 months to one year.

- Create your zero-based budget that revolves around your personal goals.

- Be accountable and stick to it!

Any other questions? For the next 3 weeks I’ll be talking about different aspects of budgeting, including:

- Little things to include in your budget (That you may be forgetting!)

- How to budget with your spouse when you’re the Free Spirit

- Things to include in a Budget Committee Meeting

If you have questions that don’t apply to any of the above, please ask in the comments! I’m not an expert but I can give my experiences and can even do a Q&A post if there’s enough demand!

Jaime is a Nutrition Coach through the ISSA and professional writer. She has 4 years experience coaching and 9 years experience in writing. She enjoys cooking easy meals, running, and learning more about food.

Jaime specializes in helping women with ADHD learn to meal plan and cook healthier meals without getting overwhelmed.